From Gold to Goldman, even Warren Buffett can go wrong. His decisions and mistakes are both man-made. The latest which caught camera lenses around the world was his “personal error” in understanding dealings of David Sokol

(one of the strongest contenders for the Berkshire crown) with his company’s capital. It all started last fall, when on December 13, Sokol picked up lubricants maker Lubrizol as the only name

(of the 18 that Citi had put forward to him) worth investing in within the short term. He asked a Citi representative to request James Hambrick, CEO of Lubrizol, for a meeting concerning a stake purchase that Sokol was

(personally) interested in. Between January 5 & 7, 2011, Sokol bought 96,060 Lubrizol shares at $104 per share

(at a total investment of $10 million). Eight days later, he suggested to the Oracle himself to buy Lubrizol shares. On March 14, Berkshire announced a $9.7 billion all-cash buyout of Lubrizol for $135 per share

(representing a 28% premium on the closing stock price, during the previous trading session – not too high as many reckoned). That very day, Buffett had openly said, “Lubrizol is exactly the sort of company with which we love to partner.” That the target was impressive was not difficult to see. Its numbers for the past five years looked strong. Sales had risen by a CAGR of 10% since FY2005, touching $5.4 billion in FY2010. So buying a company in this vertical – at much less than 2x of its annual revenues – sounded a “fair deal”. Numerically, yes. Ethically, it wasn’t.

Sokol, who was the Chairman and CEO of NetJets

(a business aviation company, 100% owned by Berkshire) and Chairman of MidAmerican Energy Holdings Co.

(89.8% owned by Berkshire), apparently had not disclosed the fact that he had made profits to the tune of close to $3 million

($2.98 million to be precise), at least not until Buffett learnt the details of Sokol’s insider trading act on March 19. Ten days later, Sokol, despite having been widely regarded as Buffett’s protégé

(Buffett bought his views on multi-billion dollar deals & praised his art of fixing problems in companies under Buffett’s umbrella), and having brought before the company an asset as promising as Lubrizol, was relieved of his duties and resigned. But that was not the end.

Buffett has set stock investments standards in the past. Now, he is in for some lessons on how to treat an unethical employee. On April 27, 2011, Berkshire issued an 18-page report, accusing the 55 year-old of “misleadingly incomplete” disclosures

(about his Lubrizol dealings) and violating “the duty of candour” he owed to the company. The matter is in SEC’s court now, and Buffett has confirmed his co-operation “with any government investigations relating to this matter.” For him, the star – but unethical – employee is already an outsider!

So, is Buffett right in firing one of his top managers and then allowing the judiciary to take over and prosecute him if found guilty? And how should you deal with an unethical divisional CEO

(or any employee, for that matter) like Sokol?

Fire unethical employees immediately. And then file a civil or criminal litigation directly on the accused.

Incidences like this have been as much a lesson for the likes of Sokol, as they have been for Buffett. It was his mistake that he did not act on Sokol’s ethical lapses in the past. Buffett should have thrown him out of the Berkshire outfit long back and taken him to court – not once, but twice – for putting Berkshire’s image at risk. Digest this: About a year back, an Omaha civil court fined Sokol-led MidAmerican Energy to pay $32 million to a group of shareholders. Reason: the company had manipulated the book of accounts of one of its projects. As per the court’s ruling, the CEO was found guilty of “intentionally” falsifying bottomline calculations, so that some minority shareholders are excluded from the benefits arising out of the project. Even in 1999, when Sokol had joined the Berkshire family, with Buffett acquiring his MidAmerican Holdings company for $2.1 billion, MidAmerican shareholders had sued him for using personal relationships and deceit to convince the board. Their claim: Sokol had cheated the shareholders of $140 million, through sale of MidAmerican for a lower $35.05 per share

(despite the company being worth $37.37 a share). The charges were proven and in 2003, the court ordered him to settle the lawsuit by paying up $7.5 million to the plaintiff.

So the fact that Sokol has done it again

(and this time against the very Buffett), comes as a no shocker, not at least to those Group CEOs & Chairmen who know how to deal with those who try and set fire to an organisation’s ethical fabric. Get rid of them – that is Bible. In a warning to Buffett’s non-action, an investor of Berkshire Hathaway has filed a lawsuit charging that “both David Sokol’s purchases and Warren Buffett’s failure to act” went against Berkshire’s policies.

Companies should be intolerant to all forms of unethical behaviour at workplace. And we are talking about everything – from insincerity, deliberate absenteeism, nepotism, being careless about information that

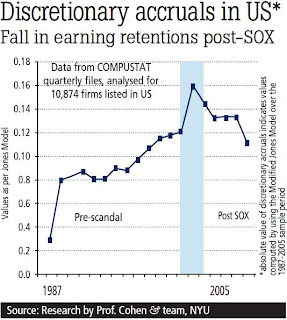

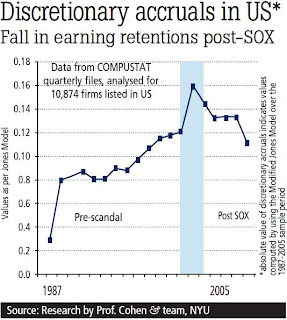

can damage reputations, to financial frauds and cheating customers, shareholders and investors alike. Especially in the last respect, the Sarbanes–Oxley Act of 2002

(also known as the ‘Public Company Accounting Reform and Investor Protection Act’) has helped limit the number of fraudulent accounting acts that company officials have undertaken since it was enacted

(in their August 2008 paper, titled, The “numbers game” in the pre and post-Sarbanes- Oxley Eras, Profs. Bartov & Cohen of Stern School of Business, conclude that, “We document a significant decline in expectations management in the Post-SOX period compared to the late 1990s. This suggests that managers have reduced their reliance on such a mechanism to just meet or beat analysts’ earnings expectations, whereas real earnings management seems to have overall increased”).Bosses should necessarily use the whip at the slightest hint of dirty-dealing by peers and juniors. And if the deed appears unforgivable, or damaging to the organisation’s culture, using the gun and sending an attorney

(to the ex-employee), is the best option. Thankfully, it is happening today in some companies.

Everyone talks about how HP’s board forced Mark Hurd and Patricia Dunn to quit following their immoral and dishonest conduct, but no one talks about how a Fortune 500 name, and the largest offprice retailer of apparel & home fashions globally

(worth $20.77 billion on NYSE and making $21.94 billion-a-year in topline) TJX Companies Inc., fired an employee Nick Benson two years back, for disclosing confidential company information over the Internet

(related to security concerns relating to its customers’ credit cards). He had made disturbing claims about security practices at TJX in an online forum, which could have resulted in serious damage of the store’s image.

There have been other instances, where companies have simply showed the door to those who do not respect predecided norms and rules. On November 10, 2010, within hours of the leakage of an internal memo regarding a salary hike from Eric Schmidt, the-then CEO of Google

(“We’ve decided to give all of you a 10% raise, effective January 1st. This salary increase is global and across the board – everyone gets a raise, no matter their level, to recognise the contribution that each and every one of you makes to Google,” is what it read), the employeein- question was fired. The memo read: “Confidential: Internal only, Googlers only.” Critics point a finger at Google’s harsh decision, but do they even realise that they are questioning the #4 name in the 2011 ranking of Fortune’s Best Companies to Work For?

Walmart, the world’s largest retailer is another example. In March 2010, Joseph Casias, a clerk at Walmart store in Battle Creek, Michigan

(who suffers from brain tumour), was given the boot after he failed a drug test. It was medical marijuana, which he claimed was allowed in Michigan. Walmart was taken to court. The ruling went in the company’s favour. On February 11, 2011, announcing his decision, US District Judge Robert Jonker said: “The fundamental problem with

(Casias’) case is that the medical marijuana law does not regulate private employment.” As per Walmart’s policy, the substance was banned, and therefore, usage of it, for whatever reason, was an act of cheating the company. Many claim that when it comes to ethics, Walmart has been particularly strict only with its lower- level employees. Untrue. In March 2005, Tom Coughlin, Wal-Mart’s Vice- Chairman and #2 executive, was forced to quit after it was proven

(through a 6 week-long investigation), that over the past couple of years, about $500,000 in unauthorised payments had been made to him

(which were obtained by making claims on falsified third-party invoices and other expense documents).

Then there is the Big Blue, IBM. In 2003, the company fired James Pacenza, a decorated Vietnam veteran. He was fired a day after he was caught accessing an adult chat room while at work

(A fellow- worker who was a witness to his deed reported the matter to the senior management). Pacenza’s defense was that he suffered from post-war traumatic stress disorder, and that his Internet addiction helped ease his psychological problems. He had breached IBM’s corporate policy which strictly prohibited the access of adult websites at work and was fired the day after the complaint was received. Many question the iron-hand with which the top management of powerful corporations maintain work ethics, which starts from the very fundamental rules set by the company. They can continue questioning. Reality is – it is “the” right thing to do. If it’s unethical, it better be out!

Studies have proven over time why having a watertight workplace ethics policy is the way to keep your business right and pumping. A year 2010 report by Hay Group and Ethics Research Centre

(US), titled, Ethics and Employee Management, made three key conclusions: “1. Positive perceptions of an organisation’s and management’s commitment to ethics is particularly important for employee engagement. Managers and supervisors should work actively to demonstrate a commitment to ethics, and encourage accountability; 2. Employees who observed misconduct were less engaged than those who did not; 67% who witnessed environmental violations were disengaged, 67% who saw the misrepresenting of financial records were disengaged, and 60% who observed insider trading were disengaged; 3. Engaged employees are more likely to report misconduct, thus reducing the company’s ethics risk.” In a year 2005 survey titled, Fast Track Leadership Survey, 1,655 employees of Fortune 500 companies were asked questions about their CEOs. Here was one of the key finding, “

Nearly all (95%) say that a CEO’s business ethics remain very important and play a meaningful role in the way business gets done. When asked to grade CEOs on specific attributes, respondents said CEOs at large companies are ruthless in their pursuit of success

(79%).” So ethics and passion to achieve success, go hand in hand.

As per a research paper by Profs. D. Michael Long and Spuma Rao, of University of Southwestern Louisiana, titled, The wealth effects of unethical business behaviour, unethical conduct involving illegal payments, bribery, environmental pollution and even insider trading, result in “a negative shareholder wealth effect because of increases in monitoring costs and risks to stakeholders of the firm. The results show that the significantly negative abnormal returns were persistent and cumulative for approximately one month following the announcement of unethical business conduct. Therefore, contrary to earlier studies, unethical business behaviour is not compatible with the goal of shareholder wealth maximisation.” [I am impressed that there is actually even the factor of “environmental pollution” included in this study. It will be good to see if anyone ever comes up with a study on the ethical nature of companies which are a threat to “health”, including tobacco and liquor companies. In my world, they are all declared unethical due to the very products they sell; and I would pull down the shutters on them!]

Forget about corporations, even at the State level, this holds true. One of the first documents that you will sign on being welcomed aboard by the Federal Government as an employee, is the Ethics Orientation form prepared by the USDA Office of Ethics. The introductory letter of the form opens thus: “To: All New Employees; Ethical conduct by Federal employees is critical in maintaining the American public’s trust in the integrity and fairness of its government.”

In today’s work environment, employees find all the more reasons to play dirty. Under such conditions, a true reform is needed in the name of strong rules for them –

have a zero-tolerance policy when it comes to ethics at the workplace. That is the secret to a flourishing business. And for you my dear CEO, that journey can start right away. Start with ethics, and you will end-up with dollars, a satisfied lot of customers, employees, and a delighted set of shareholders.