I see where Andy Rubin said Google is building a "firewall" between the Android team and Motorola Mobility (link). That's exactly what we called it when Palm licensed out its OS, and actually the firewall worked pretty well. I'm sure Google can and will prevent information leaks between the Android team and the Motorola team. Those teams do not work in the same buildings (many of them are not even in the same state), so that's pretty easy to do.

Most PalmOS licensees didn't have big worries about our firewall. They wanted to know it was in place, and they were careful about sharing information with us, but we were able to work together. The reality is that if your OS is selling well, the licensees will put up with almost anything (look at the early history of Microsoft if you doubt me). And if sales slow down, no amount of firewalling will keep them loyal. Look at the, uh, more recent history of Microsoft in mobile.

The place where Palm had trouble (okay, one of the places) was that it could not figure out what to do when the financial interests of the OS conflicted with the financial interests of the hardware team. It wasn't about the firewall, it was about the corporate business goals. To put it in Google terms, what happens when a change to Android will hurt sales at Motorola Mobility?

Let's make up an example: Suppose that Motorola needs a new feature in the OS to support its next-generation product line. It has already started building the new devices, and has...say, $200 million in parts already ordered to build them. The orders cannot be canceled, and the parts will become obsolete if not used quickly. The Android team has trouble implementing the feature, and realizes that it will have to choose between the feature that Motorola needs and another feature that HTC needs for its next-generation products. It's a zero-sum game; there are only enough engineers to produce one of the features. Who wins? Will Google accept a writedown of $200 million to protect its promise to HTC?

This is not a theoretical question; tradeoffs like that happen all the time when you're developing an OS.

Want to guess how those questions were answered when Palm hardware and Palm OS were in the same company?

I think that's the real reason why Palm and PalmSource had to be separated, and I think that's the real question Android licensees are thinking about. Not is their information safe, but would Larry Page accept a financial bloodbath at Motorola to protect other Android licensees? If Google has addressed that question, I haven't seen the answer. It's a very hard question for any CEO because it pits the interests of Android licensees against Google shareholders.

None of this will drive away Android licensees, but I think it will affect the strength of their interest in also working with Microsoft -- which, when it abuses its licensees, tends to abuse all of them equally.

Selasa, 28 Februari 2012

Information Overload: Several Different Problems Under a Single Name

I want to thank everyone who participated in the information management survey that I posted at the start of the year (link). The survey was long and complex, but more than 400 of you responded to it. I know you've got a busy life, and it was very nice of you to help.

Your responses helped to shape the work we're doing on Zekira, the new app being developed by the startup I'm working on. I have posted a summary of the survey findings here (link). I know you read Mobile Opportunity for tech industry commentary, so I'm going to continue to blog on that subject here (hopefully more frequently). I will post Zekira-related information at the Zekira weblog. If you're interested in information management issues, I hope you'll visit us there.

I think some of the survey results will be interesting to folks here, so let me give you a quick summary of the highlights.

In the tech industry, we talk a lot about information overload, but we haven't defined it very well. What I learned from the survey is that info overload means something slightly different to every person. It's not a thing, it's a range of problems caused by dealing with more information than you can hold in your head.

For some people the problem is too much e-mail. For others it's too many meetings. For still others, the biggest problem is finding a way to access the archive of old files and information they have accumulated over the years.

Some of you -- I guess I should say some of us -- have amassed truly awesome personal archives of information. Literally terabytes of data in some cases. Now if only we could get the information back out of them.

A few statistics on information overload:

--More than 40% of the respondents said they feel overwhelmed by the amount of information in their lives.

--About half of the respondents experience information overload several times a week, and about 15% experience it several times a day.

--20% of the respondents receive more than 25,000 e-mails every year.

--A quarter of the respondents receive more than 100 text messages a day.

--A third of the respondents have saved more than 100 gigabytes of business files in their personal archives.

One of the biggest challenges in creating a product to help with information overload is figuring out where to focus it. Which specific problem(s) do you want to solve? Which people care about those problems? And how do you put a dent in those problems with a startup's resources?

In the next few weeks we'll be talking about how we answered those questions. You can follow our progress at the Zekira weblog. And you can read more about the survey results here.

And again, many sincere thanks for your help.

We now return you to our regularly scheduled programming.

Your responses helped to shape the work we're doing on Zekira, the new app being developed by the startup I'm working on. I have posted a summary of the survey findings here (link). I know you read Mobile Opportunity for tech industry commentary, so I'm going to continue to blog on that subject here (hopefully more frequently). I will post Zekira-related information at the Zekira weblog. If you're interested in information management issues, I hope you'll visit us there.

I think some of the survey results will be interesting to folks here, so let me give you a quick summary of the highlights.

In the tech industry, we talk a lot about information overload, but we haven't defined it very well. What I learned from the survey is that info overload means something slightly different to every person. It's not a thing, it's a range of problems caused by dealing with more information than you can hold in your head.

For some people the problem is too much e-mail. For others it's too many meetings. For still others, the biggest problem is finding a way to access the archive of old files and information they have accumulated over the years.

Some of you -- I guess I should say some of us -- have amassed truly awesome personal archives of information. Literally terabytes of data in some cases. Now if only we could get the information back out of them.

A few statistics on information overload:

--More than 40% of the respondents said they feel overwhelmed by the amount of information in their lives.

--About half of the respondents experience information overload several times a week, and about 15% experience it several times a day.

--20% of the respondents receive more than 25,000 e-mails every year.

--A quarter of the respondents receive more than 100 text messages a day.

--A third of the respondents have saved more than 100 gigabytes of business files in their personal archives.

One of the biggest challenges in creating a product to help with information overload is figuring out where to focus it. Which specific problem(s) do you want to solve? Which people care about those problems? And how do you put a dent in those problems with a startup's resources?

In the next few weeks we'll be talking about how we answered those questions. You can follow our progress at the Zekira weblog. And you can read more about the survey results here.

And again, many sincere thanks for your help.

We now return you to our regularly scheduled programming.

Senin, 27 Februari 2012

Feroli, Harris, Sufi and West on Housing and the Transmission of Monetary Policy

I will share a link when I find one. Let me pull out a couple of paragraphs from the executive summary:

In this report, we focus on weakness in housing. Our analysis makes two broad points. First, weakness in housing and residential investment is a main impediment to a robust recovery. Second, problems related to housing have affected the transmission of monetary policy. More specifically, the unprecedented decline in house prices and residential investment has introduced headwinds that may require a more aggressive monetary response than in normal downturns. Further, problems related to housing markets may reduce the sensitivity of real economic activity to the interest rates that monetary policy can affect. Or in the parlance of textbook intermediate macroeconomics, housing problems have likely shifted the IS curve leftwards and steepened the slope of the curve by introducing a gap between policy rates and effective rates. For both of these reasons, problems related to housing introduce significant challenges to monetary policy-making.If one looks at business cycle histories (see here, here and here), it is hard to imagine full recovery without housing market recovery. Warren Buffet this morning said it was time for one. I hope he is right.

There are six steps in our analysis:

1. We begin by placing housing in the context of the broader economic recovery. The overall recovery in GDP has been one of the weakest in the postwar period even though the recession was the largest in the postwar period. Residential investment has been a particularly dismal performer. Further, the other weakest components of GDP--consumption of services and state and local government expenditures--can also be closely linked to weakness in housing markets. Focusing just on the direct impact of housing—home construction and housing service consumption—the sector accounts for about a third of the shortfall of growth relative to a typical recovery. Obviously the full impact of the housing crisis is bigger if we include indirect impacts on local governments and consumption of housing-related durables. We also show evidence from other countries that a collapse in housing is associated with subsequently weak recoveries....

Sabtu, 25 Februari 2012

Still playing consumers for suckers

So I am having a lazy Saturday watching ESPN, and see an ad where the husband says, "I need the TV," and the wife says, "We can't afford more credit card debt," and the announcer says--"you can have your TV and not take on credit card debt--by renting."

Of course, by renting, consumers are paying an implicit interest rates to RAC, the company peddling the scheme. The price of renting a Sony 55" television is $29.99 a week. The cost of a Sony 55" is $1899 on Amazon. Let's say the expected life of a Sony is four years (it is probably longer). That is an implicit IRR of 1.51 percent per week, or 117 percent per year. There used to be a word for this kind of thing, and the word was usury.

This is different from legitimate rental businesses, that rent out equipment for short periods and that have to keep inventory that often sits idle. But to suggest to consumers that they are better off not using their 24 percent APR credit cards for this scheme--it is disgraceful.

Of course, by renting, consumers are paying an implicit interest rates to RAC, the company peddling the scheme. The price of renting a Sony 55" television is $29.99 a week. The cost of a Sony 55" is $1899 on Amazon. Let's say the expected life of a Sony is four years (it is probably longer). That is an implicit IRR of 1.51 percent per week, or 117 percent per year. There used to be a word for this kind of thing, and the word was usury.

This is different from legitimate rental businesses, that rent out equipment for short periods and that have to keep inventory that often sits idle. But to suggest to consumers that they are better off not using their 24 percent APR credit cards for this scheme--it is disgraceful.

Kamis, 23 Februari 2012

ALLOW THE VALUES IN, AND WEALTH FOLLOWS

PLAN ‘A’ FOR NARAYANA MURTHY WAS ABOUT MIDDLE CLASS VALUES & GROWTH PROJECTIONS BEFORE HE REALISED THAT ENTREPRENEURSHIP IS THE KEY TO POVERTY ERADICATION IN INDIA. THE VALUES STAYED, BUT A LOT ELSE CHANGED THEREON

This happened a few years ago when I was talking to Ted Turner at a function where a few new members were being inducted into the United Nations Foundation’s board of directors. Our conversation was pretty soporific, as can be expected of such functions where one is loathe to utter politically incorrect statements. Ted suddenly stopped an individual who was passing by, and introduced him to me, mentioning, “Meet the newest board member of the UN Foundation, Narayana Murthy.”

Turner at a function where a few new members were being inducted into the United Nations Foundation’s board of directors. Our conversation was pretty soporific, as can be expected of such functions where one is loathe to utter politically incorrect statements. Ted suddenly stopped an individual who was passing by, and introduced him to me, mentioning, “Meet the newest board member of the UN Foundation, Narayana Murthy.”

The incident remains in my mind purely because of the fact that that was my first meeting with the legendary cult entrepreneur Narayana Murthy. Years later, talking to Murthy on critical issues of entrepreneurship, I realized that here was one individual who would be considered one day soon - if not already - the father of India Inc. The commitment, sincerity and dedication that Murthy has shown to not just Infosys but to the nation, in terms of bringing India on the world map and ensuring that the fruits of India’s development flowed down to the lower sections, is without argument in the league of the likes of JRD Tata.

For an entrepreneur, whose company has scaled unprecedented heights to become one of India’s most profitable companies in a remarkably short span of time, the values that have driven N. R. Narayana Murthy, now Chairman-Emeritus, Infosys in his entrepreneurial journey are quite counter intuitive – they are, in fact, values that the Indian middle class would relate more to, rather than the corporate honchos who have defined Global Inc. throughout history. These values were indeed a part of his upbringing in a middle class Kannada Madhava Brahman family. He grew up to learn that an uncompromising focus on education and respect comes before everything else.

And if you had some acquaintance with Murthy in the initial years of his career, his life seemed like an immaculately planned middle class growth path even then – with the expected ingredients of academic excellence, linear growth and the much cherished job security; in short, nothing extraordinary. He completed his B. E. in Electrical Engineering from University of Mysore and his M. Tech from Indian Institute of Technology. Moreover, Murthy was a socialist at heart, and seemed hardly the kind of person who could set up a multi-billion dollar global IT company.

And if you had some acquaintance with Murthy in the initial years of his career, his life seemed like an immaculately planned middle class growth path even then – with the expected ingredients of academic excellence, linear growth and the much cherished job security; in short, nothing extraordinary. He completed his B. E. in Electrical Engineering from University of Mysore and his M. Tech from Indian Institute of Technology. Moreover, Murthy was a socialist at heart, and seemed hardly the kind of person who could set up a multi-billion dollar global IT company.

But a few unexpected experiences changed Murthy’s mindset tremendously, and unleashed the technical brilliance and entrepreneurial dynamism that have been part of his personality since. The first was a meeting with a famous American computer scientist when he was a graduate student in Control Theory at IIT on the future of computer science. The meeting was so insightful that Murthy got committed to computer science for life. Secondly, a trip to Europe convinced him that rather than his cherished Leftist ideologies, capitalism & entrepreneurship were the most practical solutions to India’s poverty problems.

His first venture Softronics was a failure and he terminated it fairly quickly. But the learnings from that venture helped him immensely when he exited en masse with his team of engineers from Patni Computers and a loan of Rs.10000 from his wife Sudha Murthy, to form Infosys in 1981. They were – a) you are a successful entrepreneur only if the market is ready for your idea and b) it is important to have a team that has a common and an enduring value system. The consequence of the first was that Infosys was keenly focused on exports from the beginning since Murthy had realised that the Indian market wasn’t ready. And the consequence of the second was that he carefully chose his A team, the team that we all now know as the seven co-founders of Infosys. These co-founders made up their mind since the beginning that they would seek respect first from all stakeholders by adopting the highest standards of business excellence, and that money would then flow in automatically. Murthy himself additionally drove home the firm belief in equity, and gave all his colleagues 15% equity in the company, even though they were just engineers with 1-1.5 years of experience; a decision that would arguably not find any precedent in business globally.

Even if the idea was right, anyone in his right mind at that time would have been quite convinced that the time and place was horribly wrong. They were planning to export software, but they were still operating from India, where the environment for business was far from ideal in those days. They had to import their first computer and MNC banks were not ready to lend them money for the same since they were start ups. Taking a telephone connection and even importing a computer took 2-3 years. There was no data communication and they used to fax source code (imagine what a client would have felt!) to the US. Six of Murthy’s colleagues went to the US to bypass the constraints in India and interface with clients. RBI approvals for overseas travel took 8-10 days, and if you got any foreign exchange earning, 50% went to RBI. Murthy, in fact, convinced clients to send him money on the 28th or 29th of every month. It was then that he could send his overseas colleagues their maintenance allowance after giving 50% to the RBI.

Even if the idea was right, anyone in his right mind at that time would have been quite convinced that the time and place was horribly wrong. They were planning to export software, but they were still operating from India, where the environment for business was far from ideal in those days. They had to import their first computer and MNC banks were not ready to lend them money for the same since they were start ups. Taking a telephone connection and even importing a computer took 2-3 years. There was no data communication and they used to fax source code (imagine what a client would have felt!) to the US. Six of Murthy’s colleagues went to the US to bypass the constraints in India and interface with clients. RBI approvals for overseas travel took 8-10 days, and if you got any foreign exchange earning, 50% went to RBI. Murthy, in fact, convinced clients to send him money on the 28th or 29th of every month. It was then that he could send his overseas colleagues their maintenance allowance after giving 50% to the RBI.

Through all these difficulties, Murthy held steadfastly to the belief that his idea was right, and the value that his company was providing to customers was world class. And he was confident that the difficulties would ultimately give way. However, amidst a difficult initial decade (Infosys grew from an annual turnover of $14000 to $2 million between 1981 and 1991) members of his team lost hope, and found themselves drawn towards a $1 million offer that was made for the company in 1989. Murthy placated them and assured them that the future was going to be much better. He even offered to buy out their stake.

Through all these difficulties, Murthy held steadfastly to the belief that his idea was right, and the value that his company was providing to customers was world class. And he was confident that the difficulties would ultimately give way. However, amidst a difficult initial decade (Infosys grew from an annual turnover of $14000 to $2 million between 1981 and 1991) members of his team lost hope, and found themselves drawn towards a $1 million offer that was made for the company in 1989. Murthy placated them and assured them that the future was going to be much better. He even offered to buy out their stake.

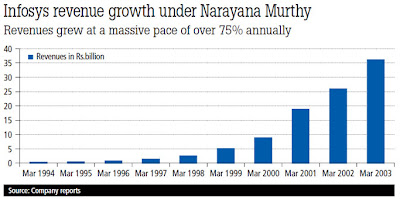

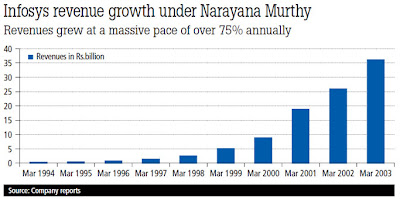

However, even Murthy would not have comprehended the not-so-small mercy that India Inc. had in store in the form of liberalisation in 1991. Infosys truly found its bearings in the new and far more enabling environment. A view at some numbers will help put this in perspective. When Murthy stepped down as CEO, revenues of Infosys stood at Rs.26.03 billion compared to Rs.290 million in 1994 (Infosys got listed in 1993). That means a CAGR of a mind boggling 75.44%! Profits were even better at Rs.9.58 billion in FY 2001-02, a CAGR of 77.79% during the same period.

As he took the company on its new trajectory, Narayana Murthy’s leadership skills were put to test time and again, and so were his value systems. In 1994, for instance, one of their largest customers GE wanted to renegotiate rates. Murthy refused and the contract was terminated, which led to a severe cash problem as GE contributed a huge 25% of Infosys’ revenues at that time (in fact, that’s when Infosys decided that it would always keep enough cash for one year’s salaries in its reserves, a diktat it follows till date). Besides, Murthy has stood by the belief that benchmarking oneself with the global best is a necessary end, as that enables you to compete in global markets and also provide world class products to your domestic market. In that spirit, he inculcated a culture of innovation across the board at Infosys. Everyone had to innovate, be it a business head in the cabins or a sweeper on the floor, and his benchmark for the same was – think of ways in which you can perform your roles faster, cheaper and better than you do them today. Another aspect that reveals Murthy’s obsession with ensuring sustainability was his approach towards derisking. For instance, he and his successor Nandan Nilekani never travelled together on the same plane! Even the listing on NASDAQ signified two very prominent aspects of Infosys DNA – great ambitions and also the willingness to embrace the highest global standards, especially in terms of corporate governance. Under him, the Infosys Leadership Institute was set up, which ensures a steady pool of next generation leaders in the company, who can be promoted to senior positions when necessary.

Infosys innovated time and again to ensure the respect of its clients. From 1992 itself, the company decided that rather than looking for short term gains, it has to build an institution for the long run. They invested in building state of the art physical infrastructure, attracting the right talent, embracing the latest trends in transparency and accountability (finance) and continuously enhancing productivity and quality standards. The sales team also innovated on ways to improve client satisfaction and deliver value. One of the most important innovations that Infosys brought in at that time was the global delivery model, and it was conceptualised and implemented by Murthy himself. The model is now immensely valued by clients as it enables Infosys to deliver its solutions from multiple locations across the globe and also enable round the clock implementation. Even today, Infosys earns around 98% of revenues from repeat customers.

Infosys innovated time and again to ensure the respect of its clients. From 1992 itself, the company decided that rather than looking for short term gains, it has to build an institution for the long run. They invested in building state of the art physical infrastructure, attracting the right talent, embracing the latest trends in transparency and accountability (finance) and continuously enhancing productivity and quality standards. The sales team also innovated on ways to improve client satisfaction and deliver value. One of the most important innovations that Infosys brought in at that time was the global delivery model, and it was conceptualised and implemented by Murthy himself. The model is now immensely valued by clients as it enables Infosys to deliver its solutions from multiple locations across the globe and also enable round the clock implementation. Even today, Infosys earns around 98% of revenues from repeat customers.

In rough times and smooth, Murthy mostly remained his calm and humble self. He has believed in taking advice from all team members before taking any decision. But he also believes that when it comes to taking the final call, the leader has to trust himself. Today, it seems hard to believe, but when Infosys launched its IPO in 1993, the issue, which was launched at an offer price of Rs.95/share (it opened trading at Rs.145/share), was actually undersubscribed (how we wish we had a functional time machine!). The saving grace was Morgan Stanley, which acquired 13% stake in Infosys at that price. For posterity sake, the Infosys share closed at Rs.3557.85 on March 31, 2002, the month when Murthy exited operational responsibilities as CEO but continued as Chairman, hence growing by 37.45 times its IPO price. The Infosys share was trading at Rs.2225.40 on August 19 last year (Murthy stepped down as Chairman on August 20), with multiple splits en route. If you invested Rs.9500 for 100 Infosys shares in 1993, your investment would have been worth Rs.28.48 million (adjusting for the splits), a capital appreciation of 299743.37%! And add the regular dividends to that too.

One is reminded of the famous quote from Mahatma Gandhi, “My life is my message.” The success of a cult entrepreneur is driven by his passion and zeal for a vision, a passion that transcends short term blips, analyst forecasts, quarterly shocks, economic malaise, et al. For Murthy, his personal ‘larger than life’ vision (apart from the Infosys’ vision) was linked to eradication of poverty. Unlike the anti-capitalist mindset that prevailed in the 1980s, Murthy was convinced that entrepreneurship and capitalism are the ways to take India ahead. He calls Infosys his experiment in entrepreneurship. Even when he moved on from Infosys, he decided to devote his energies to fostering entrepreneurship in India, which led to the formation of his VC firm Catamaran Ventures.

Murthy not only set new standards in wealth creation, but also in terms of wealth distribution. The company distributed 27% of its equity among employees after its IPO, which was valued at Rs.5 trillion. Narayana Murthy has slowly and steadily given a huge portion of his wealth to charity through the Infosys Foundation led by his wife, and has believed in giving up equity as well over time. As on December 31, 2011, the entire shareholding of the Murthy family in Infosys was just around 4.37%. Perhaps the greatest learning that Narayana Murthy would like all entrepreneurs to take up is that the power of wealth creation is secondary only to the power of giving it away. And yes, his life has been a true epitome of this message.

This happened a few years ago when I was talking to Ted

Turner at a function where a few new members were being inducted into the United Nations Foundation’s board of directors. Our conversation was pretty soporific, as can be expected of such functions where one is loathe to utter politically incorrect statements. Ted suddenly stopped an individual who was passing by, and introduced him to me, mentioning, “Meet the newest board member of the UN Foundation, Narayana Murthy.”

Turner at a function where a few new members were being inducted into the United Nations Foundation’s board of directors. Our conversation was pretty soporific, as can be expected of such functions where one is loathe to utter politically incorrect statements. Ted suddenly stopped an individual who was passing by, and introduced him to me, mentioning, “Meet the newest board member of the UN Foundation, Narayana Murthy.”The incident remains in my mind purely because of the fact that that was my first meeting with the legendary cult entrepreneur Narayana Murthy. Years later, talking to Murthy on critical issues of entrepreneurship, I realized that here was one individual who would be considered one day soon - if not already - the father of India Inc. The commitment, sincerity and dedication that Murthy has shown to not just Infosys but to the nation, in terms of bringing India on the world map and ensuring that the fruits of India’s development flowed down to the lower sections, is without argument in the league of the likes of JRD Tata.

For an entrepreneur, whose company has scaled unprecedented heights to become one of India’s most profitable companies in a remarkably short span of time, the values that have driven N. R. Narayana Murthy, now Chairman-Emeritus, Infosys in his entrepreneurial journey are quite counter intuitive – they are, in fact, values that the Indian middle class would relate more to, rather than the corporate honchos who have defined Global Inc. throughout history. These values were indeed a part of his upbringing in a middle class Kannada Madhava Brahman family. He grew up to learn that an uncompromising focus on education and respect comes before everything else.

And if you had some acquaintance with Murthy in the initial years of his career, his life seemed like an immaculately planned middle class growth path even then – with the expected ingredients of academic excellence, linear growth and the much cherished job security; in short, nothing extraordinary. He completed his B. E. in Electrical Engineering from University of Mysore and his M. Tech from Indian Institute of Technology. Moreover, Murthy was a socialist at heart, and seemed hardly the kind of person who could set up a multi-billion dollar global IT company.

And if you had some acquaintance with Murthy in the initial years of his career, his life seemed like an immaculately planned middle class growth path even then – with the expected ingredients of academic excellence, linear growth and the much cherished job security; in short, nothing extraordinary. He completed his B. E. in Electrical Engineering from University of Mysore and his M. Tech from Indian Institute of Technology. Moreover, Murthy was a socialist at heart, and seemed hardly the kind of person who could set up a multi-billion dollar global IT company.But a few unexpected experiences changed Murthy’s mindset tremendously, and unleashed the technical brilliance and entrepreneurial dynamism that have been part of his personality since. The first was a meeting with a famous American computer scientist when he was a graduate student in Control Theory at IIT on the future of computer science. The meeting was so insightful that Murthy got committed to computer science for life. Secondly, a trip to Europe convinced him that rather than his cherished Leftist ideologies, capitalism & entrepreneurship were the most practical solutions to India’s poverty problems.

His first venture Softronics was a failure and he terminated it fairly quickly. But the learnings from that venture helped him immensely when he exited en masse with his team of engineers from Patni Computers and a loan of Rs.10000 from his wife Sudha Murthy, to form Infosys in 1981. They were – a) you are a successful entrepreneur only if the market is ready for your idea and b) it is important to have a team that has a common and an enduring value system. The consequence of the first was that Infosys was keenly focused on exports from the beginning since Murthy had realised that the Indian market wasn’t ready. And the consequence of the second was that he carefully chose his A team, the team that we all now know as the seven co-founders of Infosys. These co-founders made up their mind since the beginning that they would seek respect first from all stakeholders by adopting the highest standards of business excellence, and that money would then flow in automatically. Murthy himself additionally drove home the firm belief in equity, and gave all his colleagues 15% equity in the company, even though they were just engineers with 1-1.5 years of experience; a decision that would arguably not find any precedent in business globally.

Even if the idea was right, anyone in his right mind at that time would have been quite convinced that the time and place was horribly wrong. They were planning to export software, but they were still operating from India, where the environment for business was far from ideal in those days. They had to import their first computer and MNC banks were not ready to lend them money for the same since they were start ups. Taking a telephone connection and even importing a computer took 2-3 years. There was no data communication and they used to fax source code (imagine what a client would have felt!) to the US. Six of Murthy’s colleagues went to the US to bypass the constraints in India and interface with clients. RBI approvals for overseas travel took 8-10 days, and if you got any foreign exchange earning, 50% went to RBI. Murthy, in fact, convinced clients to send him money on the 28th or 29th of every month. It was then that he could send his overseas colleagues their maintenance allowance after giving 50% to the RBI.

Even if the idea was right, anyone in his right mind at that time would have been quite convinced that the time and place was horribly wrong. They were planning to export software, but they were still operating from India, where the environment for business was far from ideal in those days. They had to import their first computer and MNC banks were not ready to lend them money for the same since they were start ups. Taking a telephone connection and even importing a computer took 2-3 years. There was no data communication and they used to fax source code (imagine what a client would have felt!) to the US. Six of Murthy’s colleagues went to the US to bypass the constraints in India and interface with clients. RBI approvals for overseas travel took 8-10 days, and if you got any foreign exchange earning, 50% went to RBI. Murthy, in fact, convinced clients to send him money on the 28th or 29th of every month. It was then that he could send his overseas colleagues their maintenance allowance after giving 50% to the RBI. Through all these difficulties, Murthy held steadfastly to the belief that his idea was right, and the value that his company was providing to customers was world class. And he was confident that the difficulties would ultimately give way. However, amidst a difficult initial decade (Infosys grew from an annual turnover of $14000 to $2 million between 1981 and 1991) members of his team lost hope, and found themselves drawn towards a $1 million offer that was made for the company in 1989. Murthy placated them and assured them that the future was going to be much better. He even offered to buy out their stake.

Through all these difficulties, Murthy held steadfastly to the belief that his idea was right, and the value that his company was providing to customers was world class. And he was confident that the difficulties would ultimately give way. However, amidst a difficult initial decade (Infosys grew from an annual turnover of $14000 to $2 million between 1981 and 1991) members of his team lost hope, and found themselves drawn towards a $1 million offer that was made for the company in 1989. Murthy placated them and assured them that the future was going to be much better. He even offered to buy out their stake.However, even Murthy would not have comprehended the not-so-small mercy that India Inc. had in store in the form of liberalisation in 1991. Infosys truly found its bearings in the new and far more enabling environment. A view at some numbers will help put this in perspective. When Murthy stepped down as CEO, revenues of Infosys stood at Rs.26.03 billion compared to Rs.290 million in 1994 (Infosys got listed in 1993). That means a CAGR of a mind boggling 75.44%! Profits were even better at Rs.9.58 billion in FY 2001-02, a CAGR of 77.79% during the same period.

As he took the company on its new trajectory, Narayana Murthy’s leadership skills were put to test time and again, and so were his value systems. In 1994, for instance, one of their largest customers GE wanted to renegotiate rates. Murthy refused and the contract was terminated, which led to a severe cash problem as GE contributed a huge 25% of Infosys’ revenues at that time (in fact, that’s when Infosys decided that it would always keep enough cash for one year’s salaries in its reserves, a diktat it follows till date). Besides, Murthy has stood by the belief that benchmarking oneself with the global best is a necessary end, as that enables you to compete in global markets and also provide world class products to your domestic market. In that spirit, he inculcated a culture of innovation across the board at Infosys. Everyone had to innovate, be it a business head in the cabins or a sweeper on the floor, and his benchmark for the same was – think of ways in which you can perform your roles faster, cheaper and better than you do them today. Another aspect that reveals Murthy’s obsession with ensuring sustainability was his approach towards derisking. For instance, he and his successor Nandan Nilekani never travelled together on the same plane! Even the listing on NASDAQ signified two very prominent aspects of Infosys DNA – great ambitions and also the willingness to embrace the highest global standards, especially in terms of corporate governance. Under him, the Infosys Leadership Institute was set up, which ensures a steady pool of next generation leaders in the company, who can be promoted to senior positions when necessary.

Infosys innovated time and again to ensure the respect of its clients. From 1992 itself, the company decided that rather than looking for short term gains, it has to build an institution for the long run. They invested in building state of the art physical infrastructure, attracting the right talent, embracing the latest trends in transparency and accountability (finance) and continuously enhancing productivity and quality standards. The sales team also innovated on ways to improve client satisfaction and deliver value. One of the most important innovations that Infosys brought in at that time was the global delivery model, and it was conceptualised and implemented by Murthy himself. The model is now immensely valued by clients as it enables Infosys to deliver its solutions from multiple locations across the globe and also enable round the clock implementation. Even today, Infosys earns around 98% of revenues from repeat customers.

Infosys innovated time and again to ensure the respect of its clients. From 1992 itself, the company decided that rather than looking for short term gains, it has to build an institution for the long run. They invested in building state of the art physical infrastructure, attracting the right talent, embracing the latest trends in transparency and accountability (finance) and continuously enhancing productivity and quality standards. The sales team also innovated on ways to improve client satisfaction and deliver value. One of the most important innovations that Infosys brought in at that time was the global delivery model, and it was conceptualised and implemented by Murthy himself. The model is now immensely valued by clients as it enables Infosys to deliver its solutions from multiple locations across the globe and also enable round the clock implementation. Even today, Infosys earns around 98% of revenues from repeat customers.In rough times and smooth, Murthy mostly remained his calm and humble self. He has believed in taking advice from all team members before taking any decision. But he also believes that when it comes to taking the final call, the leader has to trust himself. Today, it seems hard to believe, but when Infosys launched its IPO in 1993, the issue, which was launched at an offer price of Rs.95/share (it opened trading at Rs.145/share), was actually undersubscribed (how we wish we had a functional time machine!). The saving grace was Morgan Stanley, which acquired 13% stake in Infosys at that price. For posterity sake, the Infosys share closed at Rs.3557.85 on March 31, 2002, the month when Murthy exited operational responsibilities as CEO but continued as Chairman, hence growing by 37.45 times its IPO price. The Infosys share was trading at Rs.2225.40 on August 19 last year (Murthy stepped down as Chairman on August 20), with multiple splits en route. If you invested Rs.9500 for 100 Infosys shares in 1993, your investment would have been worth Rs.28.48 million (adjusting for the splits), a capital appreciation of 299743.37%! And add the regular dividends to that too.

One is reminded of the famous quote from Mahatma Gandhi, “My life is my message.” The success of a cult entrepreneur is driven by his passion and zeal for a vision, a passion that transcends short term blips, analyst forecasts, quarterly shocks, economic malaise, et al. For Murthy, his personal ‘larger than life’ vision (apart from the Infosys’ vision) was linked to eradication of poverty. Unlike the anti-capitalist mindset that prevailed in the 1980s, Murthy was convinced that entrepreneurship and capitalism are the ways to take India ahead. He calls Infosys his experiment in entrepreneurship. Even when he moved on from Infosys, he decided to devote his energies to fostering entrepreneurship in India, which led to the formation of his VC firm Catamaran Ventures.

Murthy not only set new standards in wealth creation, but also in terms of wealth distribution. The company distributed 27% of its equity among employees after its IPO, which was valued at Rs.5 trillion. Narayana Murthy has slowly and steadily given a huge portion of his wealth to charity through the Infosys Foundation led by his wife, and has believed in giving up equity as well over time. As on December 31, 2011, the entire shareholding of the Murthy family in Infosys was just around 4.37%. Perhaps the greatest learning that Narayana Murthy would like all entrepreneurs to take up is that the power of wealth creation is secondary only to the power of giving it away. And yes, his life has been a true epitome of this message.

Selasa, 21 Februari 2012

Matthew Yglesias says low income people face lower inflation

More specifically, he writes:

In any event, I find that the effective CPI for each income category is pretty much the same for 2009-2010: the CPI increase for the lowest quintile was 1.6, for the second lowest was 1.4, for the third 1.7, the fourth 1.8 and the highest 1.7. These differences look like noise to me.

I will try to figure out something using longer term data, but since expenditure shares change over time, it will be harder to glean meaning from differences in CPIs.

So I repeated an exercise I did a few years back--I looked at expenditure shares for different goods for each income quintile, and then looked at price dynamics for each expenditure category in the CPI (the matches between the CES and CPI are not perfect, but they are close. I am not sure what to do with the expenditure categories "cash contributions" and "pension contributions.").

At the same time, it’s worth noting that stagnating real working-class wages are calculated by using a meaningless overall average rate of price inflation. Some things—college tuition, apartments in Manhattan, health care—have gotten more expensive much faster than average. This means that people who buy a below-average amount of those things are better off than the statistics show.

In any event, I find that the effective CPI for each income category is pretty much the same for 2009-2010: the CPI increase for the lowest quintile was 1.6, for the second lowest was 1.4, for the third 1.7, the fourth 1.8 and the highest 1.7. These differences look like noise to me.

I will try to figure out something using longer term data, but since expenditure shares change over time, it will be harder to glean meaning from differences in CPIs.

Senin, 20 Februari 2012

What do these two places have in common?

Cudahy, California

New York, NY

What they have in common is that Cudahy's population density, at 21,684 per square mile, is not dissimilar to New York's 26,402 per square mile. I can't be positive, but I am pretty sure no building in Cudahy is more than three floors tall. New York is the 5th densest municipality in the US, while Cudahy's is 10th. If one visits Cudahy, one won't feel particularly crowded either. But there is no wasted space.

New York, NY

What they have in common is that Cudahy's population density, at 21,684 per square mile, is not dissimilar to New York's 26,402 per square mile. I can't be positive, but I am pretty sure no building in Cudahy is more than three floors tall. New York is the 5th densest municipality in the US, while Cudahy's is 10th. If one visits Cudahy, one won't feel particularly crowded either. But there is no wasted space.

Jumat, 17 Februari 2012

Professor Judith Green reminds me of the meaning of "begging the question"

Fowler defines "begging the question" as the "fallacy of

founding a conclusion on a basis that as much needs to be proved as

the conclusion itself."

I learned this in high school, and just forgot (or just got sloppy). It is a good phrase with a specific meaning--we should keep it.

founding a conclusion on a basis that as much needs to be proved as

the conclusion itself."

I learned this in high school, and just forgot (or just got sloppy). It is a good phrase with a specific meaning--we should keep it.

Paul Krugman essentially invites the question: should California secede?

In his column this morning, Paul Krugman discusses a recent Times article that shows that the reddest states receive more of their personal income from government programs than blue states. An implication of this is that places such as California would be better off fiscally by seceding from the union (my colleague Lisa Schweitzer shows that California gets less than its fair share of the gasoline tax as well).

So as someone who lives in California (and who plans to remain here until I no longer have any say about where I live), I should support secession, or at minimum, a substantial reduction in federal taxes and spending, which could then be replaced with state taxes and spending. But I care about the elderly and the poor in Oklahoma, so I guess I am stuck; yet the average voter in Oklahoma seems not to care at all about the elderly and poor in California. This leaves us stuck again.

So as someone who lives in California (and who plans to remain here until I no longer have any say about where I live), I should support secession, or at minimum, a substantial reduction in federal taxes and spending, which could then be replaced with state taxes and spending. But I care about the elderly and the poor in Oklahoma, so I guess I am stuck; yet the average voter in Oklahoma seems not to care at all about the elderly and poor in California. This leaves us stuck again.

Kamis, 16 Februari 2012

Adam Levitin on the San Francisco Audit: Why no investigation?

Adam writes:

Here's a bombshell: the San Francisco City Assessor commissioned a serious audit of foreclosure documentation filed in the past few years. The audit examined 400 foreclosures. It found problems with 85% of them, often multiple problems. What's more, some of the problems are pretty serious as they implicate not only borrowers' rights, but the integrity of mortgage-backed securities and the property title system.

The San Francisco City Assessor's audit also serves as a benchmark for evaluating the Federal-State servicing settlement. The San Francisco City Assessor managed to accomplish in a few months what the Federal government and state Attorneys General weren't able to do in nearly a year and a half with far greater resources at their disposal: perform a credible investigation of foreclosure documentation with serious implications about the securitization process in general. That's a lot of egg on the face of Shaun Donovan, Eric Holder, Tom Miller, et al. The SF City Assessor report shows that it really wasn't so hard for a motivated party to undertake a serious investigation. And that raises the question of why the largest consumer fraud settlement in history proceeded with virtually no investigation...

Read the San Francisco Assessor's Audit on Mortgage Compliance.

It is jaw-dropping. Among other things, around 30 percent of the foreclosed loans sampled from San Francsico have a minimum of three clear compliance issues.

One should not draw inferences about the rest of California from San Francisco alone--so it is time to replicate the study for some other counties.

One should not draw inferences about the rest of California from San Francisco alone--so it is time to replicate the study for some other counties.

Rabu, 15 Februari 2012

Did David Brooks think the social fabric was better when...

...we had Jim Crow? When the military was segregated? When Chinese were denied citizenship? When husbands could beat their wives? Not so long ago, this was part of the social fabric.

Senin, 13 Februari 2012

Why do people confuse "transit" with rail?

Perhaps the most important transportation economist since World War II was John Kain. Professor Kain liked transit very much, but be showed, over and over again, that urban buses were more efficient in virtually every context than urban rail: for the same amount of money, buses can take more passengers more places more conveniently than trains.

When transit agencies build expensive rail systems, they inevitably cannibalize bus systems. This has happened in Salt Lake City, in Portland, in Atlanta and in Dallas. The goal of transit should be to move people as efficiently as possible. The evidence is overwhelming that rubber tire transit beats fixed rail pretty much everywhere. So why the nostalga for an obsolete technology? I just don't understand.

When transit agencies build expensive rail systems, they inevitably cannibalize bus systems. This has happened in Salt Lake City, in Portland, in Atlanta and in Dallas. The goal of transit should be to move people as efficiently as possible. The evidence is overwhelming that rubber tire transit beats fixed rail pretty much everywhere. So why the nostalga for an obsolete technology? I just don't understand.

Jumat, 10 Februari 2012

My lexicographic voting preferences

I could no more vote for someone that opposed marriage equality than I could for someone who supported anti-miscegenation laws. And yes, for me that pretty much trumps everything else.

Rabu, 08 Februari 2012

Lisa Schweitzer on Shouting People Down

It starts:

One problem with planning, particularly for planning in the academy, concerns its normative basis: the good city, the just city, etc. Recently, a commenter here said:

That describes what a university SHOULD be, but not what I have found most universities to actually be. Anyone that disagrees with the mainstream academic viewpoint is not engaged in discussion, but shouted down. Students aren’t encouraged to explore and come up with new ideas, but to validate the ideas of their professors. Seems like the “debate” (or lack thereof) is not longer intellectual, but political and ideological.

That comment meshes with my experience in the planning academy, but not my experience with social scientists. Social scientists have their own sets of problems and limitations, but planning’s normative basis means that once consensus forms on what is good, deviations from that will be condemned not as misguided or inaccurate, but as evil. I’m not naive enough to believe the social sciences aren’t subjective and subject to ideological influences. But a common theoretical basis, such as that held in economics (however flawed), allows even for deep divisions to run alongside a rigorous body of empirical work. That is, unless you’re in macro, where ideologies rule and big names bellow at each other like mammoths across the primordial swamp about how to interpret theoretical models that have a weak empirical basis.

Read the whole thing.

Rabu, 01 Februari 2012

Two strong positives for the new Obama refinance plan

(1) It finally allows underwater borrowers to exercise an option that investors knew existed when they purchased mortgage backed securities--the prepayment option. Right now, the fact that borrowers are underwater allows investors to earn a windfall by collecting a premium on what is effectively a callable bond.

(2) It imposes a Pigou tax on large banks. When a small bank fails, the negative externality is small to non-existent. When a TBTF bank fails, the negative externality can be catastrophic. Taxes on large banks help internalize the externality.

(2) It imposes a Pigou tax on large banks. When a small bank fails, the negative externality is small to non-existent. When a TBTF bank fails, the negative externality can be catastrophic. Taxes on large banks help internalize the externality.

Rolf Pendall: Racial Segregation is Still a Reality

Rolf responds to Glaeser and Vigdor:

The Manhattan Institute for Policy Research’s website made a triumphal proclamation this week that we have reached “the end of the segregated century.” The New York Times dutifully spread the news, leading with the headline “Segregation Curtailed in U.S. Cities, Study Finds.” The story beneath the spin, however, shows that segregation isn’t just a phenomenon to look back on regretfully during African American History Month (which begins today). Segregation lives on in far too many American cities.Rolf underscores an uncomfortable point--that Northern cities have more black-white segregation than Southern cities. The largest city in my home state of Wisconsin, Milwaukee, is the most segregated large city in the country.

In 1970, two years had elapsed since Congress enacted the end of private-sector apartheid with the Fair Housing Act; only a few years before that, President Kennedy had ordered the desegregation of public housing. Why should we wonder that segregation levels have declined since then? Shouldn’t the real story be that in the nation’s second-largest metropolitan area, Chicago, over 70 percent of African Americans would have to move to a predominantly non-black neighborhood (or the same proportion of whites would have to move to mostly non-white areas) to achieve an even racial distribution? Chicago isn’t the only metropolitan area in this position: Detroit, Cleveland, and St. Louis also surpass 70 on this segregation index. New York, Baltimore, and Philadelphia—that is, a continuous band of urbanization stretching from just north of Washington, DC, to the middle of Connecticut with well over 25 million inhabitants—stand between 60 and 65. The heart of the northeast corridor still lives in a segregated century, as does the fringe of the Great Lakes. Even “less segregated” metropolitan areas still have levels of racial segregation far higher than the Fair Housing Act promised.

Langganan:

Postingan (Atom)